Navigating the Aftermath of Hurricane Helene

A Message from Brian Evans, CEO of Eastern Public LLC

In the aftermath of Hurricane Helene, property owners across the region are facing the daunting task of navigating recovery. The internet is flooded with questions from people looking for information, seeking help, and wondering how to rebuild their lives. At Eastern Public LLC, we understand the uncertainty that comes in the wake of such a disaster, and we are here to offer expert guidance through each challenge.

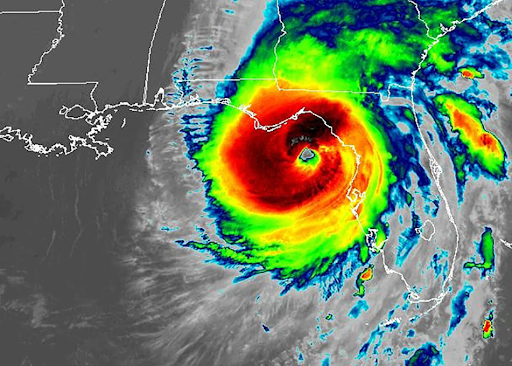

When Hurricane Helene was still approaching, many turned to the web for live updates on the storm’s path. Knowing where and when the hurricane would hit was critical for property owners who needed to prepare. While following storm tracking can help you secure your home or business, it’s just the beginning of the journey. At Eastern Public, we help you take the next steps, documenting any pre-storm conditions, so that when the damage is done, there’s a clear baseline to compare against.

As the hurricane drew closer, evacuation orders began. People scrambled to find the safest routes and nearby shelters, leaving behind their homes and businesses. Once the immediate danger passed, many property owners returned to find the aftermath of destruction. Whether you evacuated or stayed, you might now face damage that seems overwhelming. This is where we come in. Our team is prepared to step in and assess the full extent of the damage, ensuring every detail is accounted for in your insurance claim.

Even as the storm passed, its effects lingered in the form of flooding, wind damage, and power outages. People searched for forecasts to predict when it would be safe to return home, and when their power might be restored. At the same time, many were also wondering how to start the insurance process. This is one of the areas where we excel. We not only assess the visible damage but look deeper, evaluating hidden impacts such as water damage or mold that could lead to future problems if not addressed properly.

For many, the aftermath of the storm includes navigating complex insurance policies and filing claims. This is often where property owners feel the most lost. The fine print of an insurance policy can be confusing, and missing even small details can cost you significantly in your recovery. At Eastern Public, we handle the entire claims process from start to finish, making sure every bit of damage is properly documented, and every possible loss is included in your settlement. We don’t just file claims – we negotiate with the insurance company to maximize what you’re entitled to, ensuring you’re not left undercompensated.

In addition to insurance, many people affected by Hurricane Helene are searching for financial assistance and recovery resources from FEMA and other organizations. These programs can be lifesavers, but they can also be tricky to navigate. We guide our clients not just through their insurance claims, but also through any available disaster recovery resources, making sure they’re fully supported in their efforts to rebuild.

And, of course, the stress of facing a disaster doesn’t stop with property damage. The emotional toll is very real. The internet is full of searches for mental health support, as people struggle to cope with the trauma of the storm. While we’re not mental health professionals, we do everything we can to lighten your load. By taking over the complex and often stressful insurance process, we free you up to focus on your personal and emotional recovery.

Finally, in times of crisis, communities come together. People are also searching for ways to help each other, through donations or volunteering. We believe in the power of community too. By helping you get the best possible settlement from your insurance company, we hope to play a part in helping you recover more quickly, allowing you to support your own family, neighbors, and friends as they work through the aftermath of Hurricane Helene.

At

Eastern Public, we’re not just here to help you file paperwork. We’re here to be your partner in recovery, guiding you through each step, making sure no detail is overlooked, and fighting for the compensation you deserve. The road ahead may seem long, but with the right support, you can rebuild and move forward. Let us help you navigate the path to recovery.

Together, we can rebuild stronger.

Eastern Public is a complete property insurance claims and risk management firm based in New York. With over 20 years of experience, we are licensed to serve clients in the greater New York City area and across the East Coast, including New York, New Jersey, Pennsylvania, Connecticut, Massachusetts, Vermont, Maine, Rhode Island, DC, Maryland, North Carolina, South Carolina, Kentucky, and Georgia. For 24/7 claims advice and service, contact us at (929) 999.4674 or info@EasternPublic.com .

Our Work

News & Press